How to File an ITR: Essential Dos and Don’ts

Introduction:

Filing your Income Tax Return (ITR) is a crucial financial obligation for every taxpayer. It not only helps you fulfill your legal responsibilities but also allows you to stay on top of your financial affairs. To ensure a smooth and error-free ITR filing process, it’s essential to be well-informed about the dos and don’ts. In this blog post, we will guide you through the key points to consider while filing your ITR, helping you optimize your experience and comply with the tax regulations effectively.

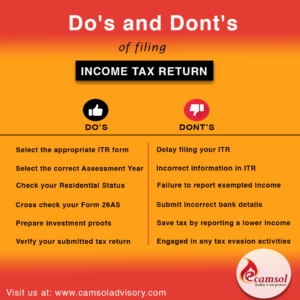

Dos for Filing ITR:

1. Gather all relevant documents: Start by collecting all the necessary documents such as Form 16 (issued by your employer), Form 26AS (annual tax statement), bank statements, investment proofs, and any other relevant supporting documents. This will ensure you have accurate and up-to-date information at hand.

2. Choose the correct ITR form: The Income Tax Department offers different ITR forms based on various categories of taxpayers and their income sources. Selecting the right form according to your income, profession, and sources will streamline the filing process and minimize the chances of errors.

3. Ensure accurate income reporting: Be diligent in reporting all your income sources, including salary, rental income, capital gains, interest income, or any other income earned during the financial year. Any discrepancies or omissions may lead to penalties or legal consequences.

4. Declare exempted income: If you have any income exempted from taxation, such as dividends from mutual funds or long-term capital gains from equity investments, ensure you mention it correctly in the ITR form. Properly declaring exempted income will help you avoid any unnecessary scrutiny from the tax authorities.

5. Double-check calculations and entries: Before submitting your ITR, meticulously review all the calculations, deductions, and entries made in the form. Simple mistakes can cause delays or complications in processing your return. Make use of online tax calculators or consult a tax professional if needed.

Don’ts for Filing ITR:

1. Don’t miss the due dates: Failing to file your ITR within the specified due dates can lead to penalties and interest on any outstanding tax liability. Stay updated with the current financial year’s deadlines to avoid unnecessary complications.

2. Avoid incorrect personal details: Ensure that you provide accurate personal details such as your name, address, PAN (Permanent Account Number), and contact information. Any errors in personal information may lead to problems in the future, including delayed refunds.

3. Don’t forget to report all bank accounts: As per the latest tax regulations, it is mandatory to report all bank accounts held by you, including those that are inactive or dormant. Failure to disclose all bank accounts can attract penalties.

4. Avoid mismatched TDS entries: Carefully verify the Tax Deducted at Source (TDS) details mentioned in your Form 16 with your Form 26AS. Mismatches can cause discrepancies, resulting in additional tax notices or delays in processing your return.

5. Don’t ignore tax-saving investments and deductions: Maximize your tax benefits by making use of various deductions and exemptions available under the Income Tax Act. Claim deductions for investments in instruments like Public Provident Fund (PPF), National Savings Certificate (NSC), health insurance premiums, and home loan interest.

Conclusion:

Filing your Income Tax Return doesn’t have to be a daunting task. By following the dos and don’ts mentioned above, you can streamline the process, ensure compliance with tax regulations, and optimize your ITR filing experience. However, if you prefer professional assistance to simplify the process and maximize your tax benefits, Camsol Advisory is here to help.

Camsol Advisory offers expert guidance and personalized support from a team of experienced tax professionals. We can assist you in choosing the right ITR form based on your income sources, ensuring accurate reporting and minimizing the risk of errors. Our experts can also help you organize and manage your financial documents, ensuring that all relevant information is readily available for a smooth filing process.

So, if you’re looking for a hassle-free and optimized ITR filing experience, consider reaching out to Camsol Advisory. Let their experts guide you through the process, saving you time, effort, and potential headaches associated with complex tax matters. Start your journey towards seamless ITR filing today with Camsol Advisory by your side.

Thank you for reading our guide on filing your Income Tax Return (ITR), Thanks for reading our blog. If you enjoyed it, we’d love to hear your feedback!

Leave a comment