Benefits of Filing Income Tax Returns Early | Camsol Advisory

1. Avoid Penalties and Interest Charges:

One of the most significant benefits of early filing is the ability to avoid penalties and interest charges. When you file your returns before the due date, you reduce the risk of missing the deadline, which could result in financial penalties imposed by the tax authorities. By filing early, you also give yourself ample time to rectify any errors or missing documents, ensuring a smooth and penalty-free tax filing process.

2. Expedited Refunds:

If you're eligible for a tax refund, filing early means receiving your refund sooner. The earlier you file, the quicker the tax authorities can process your return and issue your refund. By accessing your refund sooner, you can put the funds to good use, whether it's paying off debts, making investments, or saving for future goals.

3. Reduced Stress and Peace of Mind:

Tax season can be a stressful time for many individuals. By filing your income tax returns early, you alleviate the last-minute rush and the anxiety that comes with it. Instead of scrambling to gather documents and complete your return at the eleventh hour, early filing allows you to approach tax season with a sense of calmness and organization. Moreover, it frees up mental space to focus on other important aspects of your financial life.

4. Opportunity for Tax Planning:

Filing early provides you with ample time for tax planning. It allows you to review your financial situation, identify potential deductions or credits, and explore strategies to optimize your tax liability. By planning ahead, you can consult with tax professionals, analyze investment opportunities, and make informed decisions that can positively impact your tax returns.

5. Correcting Errors and Avoiding Audits:

Mistakes on tax returns can happen to anyone. However, filing early gives you the advantage of identifying and correcting errors before submission. By taking the time to review your returns meticulously, you minimize the chances of triggering an audit or drawing unnecessary scrutiny from tax authorities. Early filing allows for a thorough review and the opportunity to provide accurate and complete information.

Conclusion:

Filing income tax returns early offers numerous benefits that go beyond just meeting the deadline. From avoiding penalties and interest charges to reducing stress and gaining peace of mind, early filing is a smart financial move. It allows for better tax planning, faster refunds, and the opportunity to correct errors before submission. Make the wise decision this tax season and file your income tax returns early to reap these advantages and enjoy a smoother, less stressful tax-filing experience.

Remember, consulting a tax professional or referring to official tax guidelines is crucial to ensure accurate and up-to-date information for your specific tax situation.

Camsol Advisory provides ongoing support, clarifying tax matters and addressing any issues that arise.

By partnering with us, you gain peace of mind, reduced stress, and a seamless tax filing experience.

Take advantage of early filing and rely on Camsol Advisory for efficient, accurate, and hassle-free income tax return filing.

Thanks for reading our blog, please share your valuable feedback below.

1. Avoid Penalties and Interest Charges:

One of the most significant benefits of early filing is the ability to avoid penalties and interest charges. When you file your returns before the due date, you reduce the risk of missing the deadline, which could result in financial penalties imposed by the tax authorities. By filing early, you also give yourself ample time to rectify any errors or missing documents, ensuring a smooth and penalty-free tax filing process.

2. Expedited Refunds:

If you're eligible for a tax refund, filing early means receiving your refund sooner. The earlier you file, the quicker the tax authorities can process your return and issue your refund. By accessing your refund sooner, you can put the funds to good use, whether it's paying off debts, making investments, or saving for future goals.

3. Reduced Stress and Peace of Mind:

Tax season can be a stressful time for many individuals. By filing your income tax returns early, you alleviate the last-minute rush and the anxiety that comes with it. Instead of scrambling to gather documents and complete your return at the eleventh hour, early filing allows you to approach tax season with a sense of calmness and organization. Moreover, it frees up mental space to focus on other important aspects of your financial life.

4. Opportunity for Tax Planning:

Filing early provides you with ample time for tax planning. It allows you to review your financial situation, identify potential deductions or credits, and explore strategies to optimize your tax liability. By planning ahead, you can consult with tax professionals, analyze investment opportunities, and make informed decisions that can positively impact your tax returns.

5. Correcting Errors and Avoiding Audits:

Mistakes on tax returns can happen to anyone. However, filing early gives you the advantage of identifying and correcting errors before submission. By taking the time to review your returns meticulously, you minimize the chances of triggering an audit or drawing unnecessary scrutiny from tax authorities. Early filing allows for a thorough review and the opportunity to provide accurate and complete information.

Conclusion:

Filing income tax returns early offers numerous benefits that go beyond just meeting the deadline. From avoiding penalties and interest charges to reducing stress and gaining peace of mind, early filing is a smart financial move. It allows for better tax planning, faster refunds, and the opportunity to correct errors before submission. Make the wise decision this tax season and file your income tax returns early to reap these advantages and enjoy a smoother, less stressful tax-filing experience.

Remember, consulting a tax professional or referring to official tax guidelines is crucial to ensure accurate and up-to-date information for your specific tax situation.

Camsol Advisory provides ongoing support, clarifying tax matters and addressing any issues that arise.

By partnering with us, you gain peace of mind, reduced stress, and a seamless tax filing experience.

Take advantage of early filing and rely on Camsol Advisory for efficient, accurate, and hassle-free income tax return filing.

Thanks for reading our blog, please share your valuable feedback below. Factors to consider when naming your NGO

How to Name Your NGO

When starting an NGO, one of the most important decisions you will make is choosing a name. Your name is the first impression potential donors, volunteers, and partners will have of your organization, so it is important to choose something that is memorable, meaningful, and easy to spell and pronounce.Here are a few tips for choosing the perfect name for your NGO:

Think about your mission

What is the purpose of your organization? What do you hope to achieve? Your name should reflect your mission and values.Get a unique name

A unique name plays a vital role in differentiating your NGO, establishing a strong brand identity, avoiding confusion, enhancing your online presence, complying with legal requirements, and making a lasting impact on your target audience.Keep it short and simple

People should be able to remember your name easily. Avoid long, complicated names that are difficult to spell or pronounce.Be creative

Don't be afraid to think outside the box when it comes to naming your organization. Use your imagination and come up with a name that is unique and memorable.Check for trademarks

Before you choose a name, make sure it is not already trademarked by another organization. You can do a trademark search online.Register your name

Once you have chosen a name, you need to register it with the government. This will help to protect your organization's name and prevent others from using it.Here are a few examples of well-chosen Indian NGO names:

- Aangan: This name means "courtyard" in Hindi, and it is a fitting name for an NGO that works to empower women and children. The courtyard is a traditional place for women to gather and socialize, and it is also a place where children can play and learn. The name Aangan evokes a sense of community and support, which are essential ingredients for social change.

- Barefoot College: This name is a reference to the fact that the founder of the organization, Bunker Roy, believed that education should be accessible to everyone, regardless of their social status or financial situation. The name Barefoot College is a reminder that education is a powerful tool that can help people to lift themselves out of poverty.

- CRY: This acronym stands for Child Rights and You. This name is a clear and concise way to communicate the organization's mission, which is to protect and promote the rights of children in India.

- Hamara Mahila: This name means "our women" in Hindi. It is a powerful name that reflects the organization's commitment to empowering women in India.

- Pratham: This name means "first" in Hindi. It is a fitting name for an organization that is committed to early childhood education. Early childhood education is the foundation for lifelong learning, and Pratham is working to ensure that all children in India have access to quality education.

How to File an ITR: Essential Dos and Don’ts

Introduction:

Filing your Income Tax Return (ITR) is a crucial financial obligation for every taxpayer. It not only helps you fulfill your legal responsibilities but also allows you to stay on top of your financial affairs. To ensure a smooth and error-free ITR filing process, it's essential to be well-informed about the dos and don'ts. In this blog post, we will guide you through the key points to consider while filing your ITR, helping you optimize your experience and comply with the tax regulations effectively.

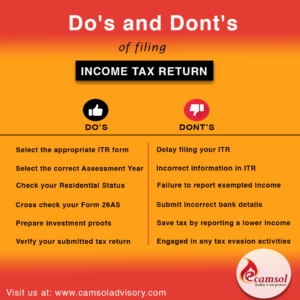

Dos for Filing ITR:

1. Gather all relevant documents: Start by collecting all the necessary documents such as Form 16 (issued by your employer), Form 26AS (annual tax statement), bank statements, investment proofs, and any other relevant supporting documents. This will ensure you have accurate and up-to-date information at hand. 2. Choose the correct ITR form: The Income Tax Department offers different ITR forms based on various categories of taxpayers and their income sources. Selecting the right form according to your income, profession, and sources will streamline the filing process and minimize the chances of errors. 3. Ensure accurate income reporting: Be diligent in reporting all your income sources, including salary, rental income, capital gains, interest income, or any other income earned during the financial year. Any discrepancies or omissions may lead to penalties or legal consequences. 4. Declare exempted income: If you have any income exempted from taxation, such as dividends from mutual funds or long-term capital gains from equity investments, ensure you mention it correctly in the ITR form. Properly declaring exempted income will help you avoid any unnecessary scrutiny from the tax authorities. 5. Double-check calculations and entries: Before submitting your ITR, meticulously review all the calculations, deductions, and entries made in the form. Simple mistakes can cause delays or complications in processing your return. Make use of online tax calculators or consult a tax professional if needed.Don'ts for Filing ITR:

1. Don't miss the due dates: Failing to file your ITR within the specified due dates can lead to penalties and interest on any outstanding tax liability. Stay updated with the current financial year's deadlines to avoid unnecessary complications. 2. Avoid incorrect personal details: Ensure that you provide accurate personal details such as your name, address, PAN (Permanent Account Number), and contact information. Any errors in personal information may lead to problems in the future, including delayed refunds. 3. Don't forget to report all bank accounts: As per the latest tax regulations, it is mandatory to report all bank accounts held by you, including those that are inactive or dormant. Failure to disclose all bank accounts can attract penalties. 4. Avoid mismatched TDS entries: Carefully verify the Tax Deducted at Source (TDS) details mentioned in your Form 16 with your Form 26AS. Mismatches can cause discrepancies, resulting in additional tax notices or delays in processing your return. 5. Don't ignore tax-saving investments and deductions: Maximize your tax benefits by making use of various deductions and exemptions available under the Income Tax Act. Claim deductions for investments in instruments like Public Provident Fund (PPF), National Savings Certificate (NSC), health insurance premiums, and home loan interest.Conclusion:

Filing your Income Tax Return doesn't have to be a daunting task. By following the dos and don'ts mentioned above, you can streamline the process, ensure compliance with tax regulations, and optimize your ITR filing experience. However, if you prefer professional assistance to simplify the process and maximize your tax benefits, Camsol Advisory is here to help. Camsol Advisory offers expert guidance and personalized support from a team of experienced tax professionals. We can assist you in choosing the right ITR form based on your income sources, ensuring accurate reporting and minimizing the risk of errors. Our experts can also help you organize and manage your financial documents, ensuring that all relevant information is readily available for a smooth filing process. So, if you're looking for a hassle-free and optimized ITR filing experience, consider reaching out to Camsol Advisory. Let their experts guide you through the process, saving you time, effort, and potential headaches associated with complex tax matters. Start your journey towards seamless ITR filing today with Camsol Advisory by your side. Thank you for reading our guide on filing your Income Tax Return (ITR), Thanks for reading our blog. If you enjoyed it, we’d love to hear your feedback!A Step-by-Step Guide to Registering a Partnership Company in India

- Gain In-depth Knowledge of the Partnership Company Structure:

- Carefully Select an Apt and Distinctive Partnership Name:

- Craft a Comprehensive Partnership Deed:

- Obtain a Partnership PAN (Permanent Account Number):

- Register with the Registrar of Firms for Enhanced Legitimacy:

- Obtain Requisite Licenses and Permits:

- Establish a Bank Account for Your Partnership:

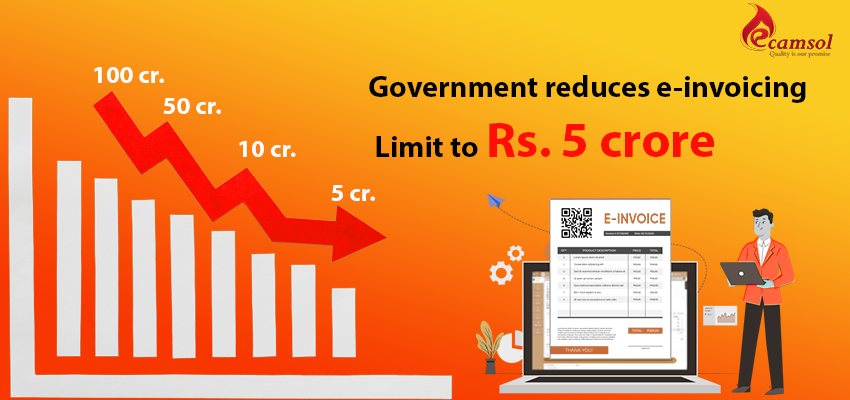

Indian Government Reduces E-Invoice Limit to Rs. 5 Crores

- Reduced paperwork: e-invoicing eliminates the need for paper invoices, which can save businesses time and money.

- Faster payment processing: e-invoices can be processed more quickly than paper invoices, which can help businesses get paid faster.

- Improved accuracy: e-invoicing can help businesses improve the accuracy of their invoices, which can reduce errors and discrepancies.

- Increased transparency: e-invoicing provides a digital trail of transactions, which can help businesses improve their transparency and accountability.

- Reduced risk of fraud: e-invoicing can help businesses reduce the risk of fraud by providing a more secure way to transmit invoices.

Are you beginning your individual Business?

Are you starting your own Business? If Yes! Have you drafted a Business Plan but ?

Wanted to share with you that 80% of startups failures are due to lack of planning for their enterprise . So. How is that you're planning your startup success. Before you step into the startup journey, you must be prepared for the ways to search its successful vacation spot . Drafting a marketing strategy might help you visualize any issues you would possibly face after beginning up your online business . So, earlier than you begin up, you have to do a radical analysis of your online business . Here are the pointers you have to to be able to create your marketing strategy .#1 Plan Summary

You should make notes of every facet of your online business . This will make it easier to to validate your online business concept . Note down Your Mission, Your Vision, and Your Purpose. Conceptualize and make transient be aware for every and the whole lot wanted for working your online business efficiently .#2 Targeted Market

Know your focused market by defining for whom your product or providers are supposed for. Try to visualize the demographics (Location, Age, Gender, Income group, Interest) of your focused clients . Try to search out out why your focused clients should purchase your product or providers . Learn how a lot they're keen to pay on your Product/service.#3 Competitors Study

Learn as a lot as you may about your opponents this can play a really essential function in your advertising and marketing and gross sales proposition. Define your competitor's strengths and weaknesses. Define your aggressive advantages- what further efforts you're keen to take? What makes you distinctive ? What is your USP (Unique Selling Point)?#4 Human Resource

Human capital in an integral a part of any enterprise . You should determine , whether or not you want further workers to run your online business ? How a lot are you keen to pay them? How a lot expertise should they possess? What expertise do they should have? And so on.#5 Vendors & suppliers

For each enterprise whether or not they're into manufacturing, buying and selling or into service business , want a set of dependable distributors and suppliers. How many suppliers will you be utilizing frequently ? How are you going to endure that you simply get a dependable provide of inputs to run your online business . Consistent provide of uncooked materials at aggressive value could also be successful prerequisite for each enterprise .#6 Marketing Plan

Start planning about advertising and marketing methods to focus on your clients . You ought to take into consideration methods to achieve buyer 's consideration and to showcase your Product/ providers in entrance of them? Which medium will you employ to succeed in your clients ? How will you talk your message to them? What is value allocation? What is the anticipated ROI (Return on Investment)?#7 Operations

Describing the enterprise operations embrace what you'll do to run your online business effectively . What can be your working hours? How will you deal with each day work? How will your operations ship a WOW expertise to your clients ?#8 Finance Management

How a lot cash do it's worthwhile to begin /run the enterprise ? What are the sources to keep up constructive cashflow? Work out the anticipated profitability of the corporate ? What are the mounted and variable prices for working the enterprise ? How to cut back the pointless value or bills ?#9 Legalities & Compliances

Startup legalities contain getting well timed registration of GST, Trademarking of brand name , MSME certificates , copyrighting of content material , well timed ROC filings and well timed accounting course of . For Startups and SMEs drafting a legally viable enterprise agreements and contracts is a prime precedence . Camsol Advisory helps you in the entire above legalities both freed from value or pocket pleasant method .All about Private Limited Company: A Complete Guide

Characteristics of Private Limited Company

- Members– To begin an organization, a minimal variety of 2 members are required and a most variety of 200 members as per the provisions of the Companies Act, 2013.

- Limited Liability– The legal responsibility of every member or shareholder is proscribed. It implies that if an organization faces loss underneath any circumstances then its shareholders are liable to promote their very own belongings for fee. The private, particular person belongings of the shareholders are usually not in danger.

- Perpetual succession– The firm retains on present within the eyes of regulation even within the case of demise, insolvency, the chapter of any of its members. This results in the perpetual succession of the corporate. The lifetime of the corporate retains on present without end.

- Index of members– A non-public firm has a privilege over the general public firm because it don’t need to preserve an index of its members whereas the general public firm is required to take care of an index of its members.

- A variety of administrators– When it involves administrators a personal firm must have solely two administrators. With the existence of two administrators, a personal firm can come into operations.

- Paid-up capital– No minimum paid up capital required for starting a private Limited company.

- Prospectus– Prospectus is an in depth assertion of the corporate affairs that's issued by an organization for its public. However, within the case of a private limited company, there isn't a such must challenge a prospectus as a result of this public shouldn't be invited to subscribe for the shares of the corporate.

- Minimum subscription– It is the quantity acquired by the corporate which is 90% of the shares issued inside a sure time frame. If the corporate shouldn't be in a position to obtain 90% of the quantity then they can not begin additional enterprise. In the case of a personal restricted firm, shares could be allotted to the general public with out receiving the minimal subscription.

- Name– It is necessary for all non-public firms to make use of the phrase non-public restricted after its identify.

Procedure to register Private Limited Company

Once a reputation for the corporate is determined, the next steps need to be taken by the applicant: Step 1: Apply for Digital Signature Certificate (DSC) and Director Identification Number (DIN) Step 2: Apply for the identify availability Step 3: File the MOA and AOA to register the non-public restricted firm Step 4: Apply for the PAN and TAN of the corporate Step 5: Certificate of incorporation will probably be issued by ROC with PAN and TAN Step 6: Open a present checking account on the corporate identifyRequirements for Private Limited Company Registration

The necessities for non-public restricted company registration are: Members- A minimal variety of two and a most variety of 200 members or shareholders are required as per the businesses’ act 2013 earlier than registration of the corporate.

Members- A minimal variety of two and a most variety of 200 members or shareholders are required as per the businesses’ act 2013 earlier than registration of the corporate.

Directors- A minimal variety of two administrators is required for registering the non-public restricted firm. Each of the administrators ought to have DIN i.e. director identification quantity which is given by the ministry of company affairs. One of the administrators have to be a resident of India which implies he/she ought to have stayed in India for not lower than 182 days in a earlier calendar 12 months.

Directors- A minimal variety of two administrators is required for registering the non-public restricted firm. Each of the administrators ought to have DIN i.e. director identification quantity which is given by the ministry of company affairs. One of the administrators have to be a resident of India which implies he/she ought to have stayed in India for not lower than 182 days in a earlier calendar 12 months.

Name- It is among the main parts of a personal restricted firm. The identify of the corporate incorporates three components i.e. the identify, the exercise, and personal restricted firm. It is important for all non-public firms to make use of the phrase non-public restricted firm on the finish of its firm identify. Every firm has to ship 5-6 names for approval to the registrar of the corporate and all of the names must be distinctive and expressive. The identify for approval shouldn't resemble with every other firms identify. So selecting the best firm identify is a vital element is it'll stick with the corporate all through its life.

Name- It is among the main parts of a personal restricted firm. The identify of the corporate incorporates three components i.e. the identify, the exercise, and personal restricted firm. It is important for all non-public firms to make use of the phrase non-public restricted firm on the finish of its firm identify. Every firm has to ship 5-6 names for approval to the registrar of the corporate and all of the names must be distinctive and expressive. The identify for approval shouldn't resemble with every other firms identify. So selecting the best firm identify is a vital element is it'll stick with the corporate all through its life.

Registered workplace address- While going for the registration of the corporate, the proprietor ought to present the short-term tackle of the corporate till it doesn't get register. However when the corporate has been registered then the everlasting tackle of its registered workplace must be suited with the registrar of the corporate. The Registered workplace of the corporate is the place the corporate’s important affairs are been performed and the place all of the paperwork are positioned.

Registered workplace address- While going for the registration of the corporate, the proprietor ought to present the short-term tackle of the corporate till it doesn't get register. However when the corporate has been registered then the everlasting tackle of its registered workplace must be suited with the registrar of the corporate. The Registered workplace of the corporate is the place the corporate’s important affairs are been performed and the place all of the paperwork are positioned.

Obtaining a digital signature certificate- In at the moment’s fashionable world every little thing is completed on-line. All paperwork are submitted electronically and for that, each firm should get hold of a digital signature certificate which is used to confirm the authenticity of the paperwork. A digital signature is obtained by all the administrators that are marked on all of the paperwork by each director.

Obtaining a digital signature certificate- In at the moment’s fashionable world every little thing is completed on-line. All paperwork are submitted electronically and for that, each firm should get hold of a digital signature certificate which is used to confirm the authenticity of the paperwork. A digital signature is obtained by all the administrators that are marked on all of the paperwork by each director.

Professional certification- In an organization there are a lot of professionals which have required for a lot of functions. For incorporating a personal restricted firm certification by these professionals are needed. Various professionals corresponding to firm secretary, chartered accountants, price accountants, and many others are required to make their certification on the time of firm incorporation.

Professional certification- In an organization there are a lot of professionals which have required for a lot of functions. For incorporating a personal restricted firm certification by these professionals are needed. Various professionals corresponding to firm secretary, chartered accountants, price accountants, and many others are required to make their certification on the time of firm incorporation.

Advantages of Private Limited Companies

- OWNERSHIP

- MINIMUM NUMBER OF SHAREHOLDERS

- LEGAL FORMALITIES

- DISCLOSING INFORMATION

- MANAGEMENT AND DECISION MAKING

- FOCUS OF MANAGEMENT

- STOCK MARKET PRESSURE

- LONG TERM PLANNING

- MINIMUM SHARE CAPITAL

- CONFIDENTIAL

Documents required

- Share capital quantity and proposed ratio for holding shares.

- A quick description of the corporate and the enterprise.

- Name of the town the place the registered workplace of the corporate is situated.

- Ownership and sale deed (In case your personal premise).

- Identity proof of the Directors and Shareholders (PAN Card).

- Address proof of the registered workplace (Electricity invoice, phone invoice, and many others.)

- Address proof of the Director or the Shareholder (Voter ID, Passport, Driving license, and many others.)

- A duplicate copy of the newest electrical energy invoice, phone invoice, or cellular invoice for administrators.

- Occupation particulars of administrators in addition to shareholders.

- Email tackle of the administrators and shareholders.

- Contact particulars of administrators and shareholders.

- Passport measurement photograph of administrators and shareholders.

- In case the property is on lease then it's good to submit a replica of the lease settlement with No Objection Certificate (NOC) from the owner.

- Affidavits for non- acceptance.

- NOC for a change within the unique subscribers of MOA.

- MoA and the AoA subscriber sheets.

- PAN Card of the corporate.

- In case you're a overseas nationwide subscriber then it's good to present Nationality proof.

IEC Code Updations

As per the Trade Notice 18/2021-2022 dated 20th September 2021 of Directorate General of Foreign Trade, All the IECs which is not updated before 5th October 2021 will be deactivated from 06th October 2021

Subject: De-Activation of IECs not updated on the DGFT

This Trade Notice is being issued in reference to the Notification on dated 09.08.2021 whereby it was mandated by DGFT to all IEC holders to ensure that the IEC holders who had not updated their IECs, the period of updation was extended upto 31st July 2021 and subsequently to 31st August 2021.

All IECs which have not been updated after 01.01.2005 shall be de-activated with effect from 06.10.2021. The list of such IECs may be seen at the given link https://www.dgft.gov.in/CP/?opt=dgft-ra

The concerned IEC holders are provided one final opportunity to update their IEC in this interim period till 05.10.2021, failing which the given IECs shall be de-activated from 06.10.2021. Any IEC where an online updation application has been submitted but are pending with the DGFT RA for approval shall be excluded from the de-activation list.

It may further be noted that any IEC so de-activated, would have the opportunity for automatic re-activation without any manual intervention or a physical visit to the DGFT RA. For IEC re-activation after 06.10.2021, the said IEC holder may navigate to the DGFT website and update their IEC online. Upon successful updation the given IEC shall be activated again.