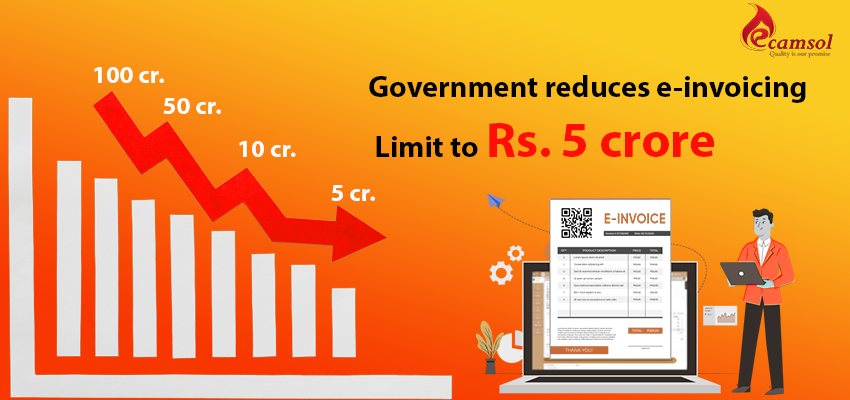

Indian Government Reduces E-Invoice Limit to Rs. 5 Crores

The Indian government has recently announced its decision to reduce the e-invoice limit from Rs. 10 Crores to Rs. 5 Crores from 1st August 2023. This means that businesses with a turnover above Rs. 5 Crores will be required to generate electronic invoices for their transactions. The move is aimed at promoting digital transactions and reducing the scope for tax evasion.

What is E-invoicing?

E-invoicing is the process of electronically generating and submitting invoices for business transactions. It is an efficient and convenient way of managing transactions that has been gaining popularity worldwide.

The Indian government first introduced e-invoicing in 2020 for businesses with an annual turnover of over Rs. 500 Crores. The system was then expanded to cover businesses with an annual turnover of over Rs. 100 Crores in 2021, and then to Rs.10 Crores in 2022. The latest decision to reduce the limit to Rs. 5 crore is a crucial step in promoting digital transactions for Indian businesses.

Benefits of E-invoicing

There are several benefits of e-invoicing for businesses, including:

- Reduced paperwork: e-invoicing eliminates the need for paper invoices, which can save businesses time and money.

- Faster payment processing: e-invoices can be processed more quickly than paper invoices, which can help businesses get paid faster.

- Improved accuracy: e-invoicing can help businesses improve the accuracy of their invoices, which can reduce errors and discrepancies.

- Increased transparency: e-invoicing provides a digital trail of transactions, which can help businesses improve their transparency and accountability.

- Reduced risk of fraud: e-invoicing can help businesses reduce the risk of fraud by providing a more secure way to transmit invoices.

The implementation of e-invoicing can be a challenge for some businesses, but the benefits of e-invoicing can outweigh the challenges. Businesses that are not yet compliant with the e-invoicing requirements should start planning for the transition as soon as possible.

Camsol Advisory Can Help Businesses with E-invoicing

Camsol Advisory is a leading accounting firm in India that specializes in helping businesses comply with government regulations. We have a team of experienced professionals who can help businesses with everything from setting up the e-invoicing system to training their staff on how to use it.

In addition, we offer various other IT-related services such as tax audits, responding to IT notices, rectification of errors, preparation and filing of ITR, compliance and documentation, and representation before tax authorities. At Camsol Advisory, our experienced professionals can provide comprehensive assistance to businesses in meeting their regulatory requirements and ensuring compliance with government regulations.

Contact Camsol Advisory Today

To learn more about how Camsol Advisory can help your business with e-invoicing, please contact us today. We would be happy to answer any of your questions and provide you with a free consultation.

Useful content