Big Tax Relief: Senior Citizens Exempt from 10% TDS on FD Interest! Stay Updated – Camsol Advisory

In a significant development, senior citizens can now enjoy a tax exemption on Fixed Deposit (FD) interest. The government has introduced a tax concession aimed at benefiting the elderly population. If you're a senior citizen looking to avoid the 10% Tax Deducted at Source (TDS) on your FD interest, there are important measures you need to take.

Let's explore the rules and steps you should follow to avail this exemption.

Submitting Self-Declaration Forms:

At the beginning of the financial year, senior citizens should submit self-declaration forms to their bank. These forms include Form 15G and Form 15H. By doing so, you can request the bank not to deduct tax on the interest if your taxable income falls below the tax-exempt limit.

Form 12BBA for Senior Citizens Aged 75 and Above:

Starting this year, senior citizens aged 75 years and above, who do not wish to file income tax returns, can submit Form 12BBA to their bank. This form allows them to be exempt from filing income tax returns altogether.

Eligibility Criteria for Exemption:

To be eligible for the income tax return exemption, senior citizens must have income only from interest on pension and fixed deposits. Additionally, the pension and fixed deposit should be held in the same bank. Form 12BBA requires various details to be filled in, including deductions under sections 80C to 80U, tax rebate under section 87A, and total income from interest on fixed deposits and FDs.

How it Works:

Once the form is submitted, the bank calculates the total income of the taxpayer. This calculation considers tax deductions and rebates under section 87A, deducting the applicable tax from the final income based on the slab rate.

Assistance from Banks:

The Central Board of Direct Taxes (CBDT) has instructed banks to assist senior citizens in filling out Form 12BBA. This support ensures a smooth process, as senior citizens often find it challenging to navigate the ever-changing rules of income tax filing.

Benefits of Submitting Form 12BBA:

Apart from the exemption, submitting Form 12BBA offers additional advantages for senior citizens. One such benefit is the elimination of concerns regarding the refund of tax deducted on FD interest. If a senior citizen aged 60 years and above has an interest income exceeding Rs 50,000 in a financial year, the bank will deduct 10% TDS. However, by submitting Form 12BBA, the taxpayer will only have to pay a reduced tax amount of Rs 52,500, thereby receiving a refund of Rs 17,500.

20% Tax Penalty for Failure to Submit PAN Card:

If a depositor fails to submit their Permanent Account Number (PAN), a higher tax rate of 20% will be levied on the FD interest. In cases where the interest received is within the exemption limit, but the bank still deducted TDS, taxpayers can claim a refund while filing their income tax return.

Conclusion:

The recent income tax exemption for senior citizens provides a valuable opportunity to avoid paying 10% TDS on FD interest. By following the necessary steps, such as submitting the required forms and seeking assistance from banks, senior citizens can enjoy a hassle-free tax filing experience. Take advantage of this breakthrough and maximize your tax benefits today.

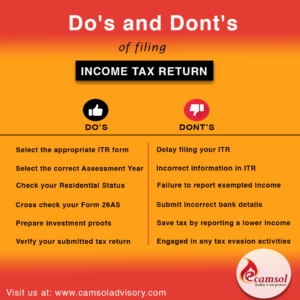

1. Avoid Penalties and Interest Charges:

One of the most significant benefits of early filing is the ability to avoid penalties and interest charges. When you file your returns before the due date, you reduce the risk of missing the deadline, which could result in financial penalties imposed by the tax authorities. By filing early, you also give yourself ample time to rectify any errors or missing documents, ensuring a smooth and penalty-free tax filing process.

2. Expedited Refunds:

If you're eligible for a tax refund, filing early means receiving your refund sooner. The earlier you file, the quicker the tax authorities can process your return and issue your refund. By accessing your refund sooner, you can put the funds to good use, whether it's paying off debts, making investments, or saving for future goals.

3. Reduced Stress and Peace of Mind:

Tax season can be a stressful time for many individuals. By filing your income tax returns early, you alleviate the last-minute rush and the anxiety that comes with it. Instead of scrambling to gather documents and complete your return at the eleventh hour, early filing allows you to approach tax season with a sense of calmness and organization. Moreover, it frees up mental space to focus on other important aspects of your financial life.

4. Opportunity for Tax Planning:

Filing early provides you with ample time for tax planning. It allows you to review your financial situation, identify potential deductions or credits, and explore strategies to optimize your tax liability. By planning ahead, you can consult with tax professionals, analyze investment opportunities, and make informed decisions that can positively impact your tax returns.

5. Correcting Errors and Avoiding Audits:

Mistakes on tax returns can happen to anyone. However, filing early gives you the advantage of identifying and correcting errors before submission. By taking the time to review your returns meticulously, you minimize the chances of triggering an audit or drawing unnecessary scrutiny from tax authorities. Early filing allows for a thorough review and the opportunity to provide accurate and complete information.

Conclusion:

Filing income tax returns early offers numerous benefits that go beyond just meeting the deadline. From avoiding penalties and interest charges to reducing stress and gaining peace of mind, early filing is a smart financial move. It allows for better tax planning, faster refunds, and the opportunity to correct errors before submission. Make the wise decision this tax season and file your income tax returns early to reap these advantages and enjoy a smoother, less stressful tax-filing experience.

Remember, consulting a tax professional or referring to official tax guidelines is crucial to ensure accurate and up-to-date information for your specific tax situation.

1. Avoid Penalties and Interest Charges:

One of the most significant benefits of early filing is the ability to avoid penalties and interest charges. When you file your returns before the due date, you reduce the risk of missing the deadline, which could result in financial penalties imposed by the tax authorities. By filing early, you also give yourself ample time to rectify any errors or missing documents, ensuring a smooth and penalty-free tax filing process.

2. Expedited Refunds:

If you're eligible for a tax refund, filing early means receiving your refund sooner. The earlier you file, the quicker the tax authorities can process your return and issue your refund. By accessing your refund sooner, you can put the funds to good use, whether it's paying off debts, making investments, or saving for future goals.

3. Reduced Stress and Peace of Mind:

Tax season can be a stressful time for many individuals. By filing your income tax returns early, you alleviate the last-minute rush and the anxiety that comes with it. Instead of scrambling to gather documents and complete your return at the eleventh hour, early filing allows you to approach tax season with a sense of calmness and organization. Moreover, it frees up mental space to focus on other important aspects of your financial life.

4. Opportunity for Tax Planning:

Filing early provides you with ample time for tax planning. It allows you to review your financial situation, identify potential deductions or credits, and explore strategies to optimize your tax liability. By planning ahead, you can consult with tax professionals, analyze investment opportunities, and make informed decisions that can positively impact your tax returns.

5. Correcting Errors and Avoiding Audits:

Mistakes on tax returns can happen to anyone. However, filing early gives you the advantage of identifying and correcting errors before submission. By taking the time to review your returns meticulously, you minimize the chances of triggering an audit or drawing unnecessary scrutiny from tax authorities. Early filing allows for a thorough review and the opportunity to provide accurate and complete information.

Conclusion:

Filing income tax returns early offers numerous benefits that go beyond just meeting the deadline. From avoiding penalties and interest charges to reducing stress and gaining peace of mind, early filing is a smart financial move. It allows for better tax planning, faster refunds, and the opportunity to correct errors before submission. Make the wise decision this tax season and file your income tax returns early to reap these advantages and enjoy a smoother, less stressful tax-filing experience.

Remember, consulting a tax professional or referring to official tax guidelines is crucial to ensure accurate and up-to-date information for your specific tax situation.