CBDT Extends ITR Filing Due Date to September 15, 2025 – Major Relief for Taxpayers

In a significant update for taxpayers across India, the Central Board of Direct Taxes (CBDT)

has officially extended the Income Tax Return (ITR) filing due date for Assessment Year (AY)

2025-26. The previous deadline of July 31, 2025, has now been extended to September 15,

2025, offering much-needed breathing room for individuals and businesses alike.

Why Has the ITR Filing Due Date Been Extended?

According to the Income Tax Department, the revised ITR forms for AY 2025-26 have

undergone major structural and content changes to simplify the compliance process and

improve the accuracy of tax reporting. These updates have made it necessary to develop,

integrate, and thoroughly test the new ITR utilities before they are rolled out for public use.

TDS Credit Delay Also a Factor

Another reason behind the extension is the delay in Tax Deducted at Source (TDS) credit

availability. Although TDS statements are required to be filed by May 31, 2025, they are

expected to start reflecting in the income tax system only by early June 2025. Without an

extended deadline, the effective filing window for taxpayers would have been too narrow,

increasing the risk of errors and mismatches.

Aimed at Smoother Filing Experience

The CBDT’s decision takes into account multiple concerns raised by taxpayers, chartered

accountants, and industry professionals, who feared last-minute technical issues and

compliance hurdles due to the compressed timeline. By granting this extension, the department

aims to provide a more convenient, error-free, and digitally efficient income tax filing

experience.

Official Notification on ITR Extension to Follow

While the extension has already been announced via the Income Tax Department’s official “X”

(formerly Twitter) handle, a formal notification confirming the new ITR due date is

expected to be released shortly.

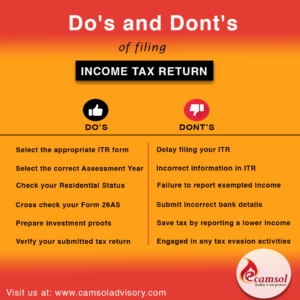

What Should Taxpayers Do Now?

- Stay updated with the official CBDT notification.

- Review the new ITR forms and get familiar with format changes.

- Ensure that your TDS details are correctly reflected.

- Consult your tax advisor or CA early to avoid last-minute complications.

1. Avoid Penalties and Interest Charges:

One of the most significant benefits of early filing is the ability to avoid penalties and interest charges. When you file your returns before the due date, you reduce the risk of missing the deadline, which could result in financial penalties imposed by the tax authorities. By filing early, you also give yourself ample time to rectify any errors or missing documents, ensuring a smooth and penalty-free tax filing process.

2. Expedited Refunds:

If you're eligible for a tax refund, filing early means receiving your refund sooner. The earlier you file, the quicker the tax authorities can process your return and issue your refund. By accessing your refund sooner, you can put the funds to good use, whether it's paying off debts, making investments, or saving for future goals.

3. Reduced Stress and Peace of Mind:

Tax season can be a stressful time for many individuals. By filing your income tax returns early, you alleviate the last-minute rush and the anxiety that comes with it. Instead of scrambling to gather documents and complete your return at the eleventh hour, early filing allows you to approach tax season with a sense of calmness and organization. Moreover, it frees up mental space to focus on other important aspects of your financial life.

4. Opportunity for Tax Planning:

Filing early provides you with ample time for tax planning. It allows you to review your financial situation, identify potential deductions or credits, and explore strategies to optimize your tax liability. By planning ahead, you can consult with tax professionals, analyze investment opportunities, and make informed decisions that can positively impact your tax returns.

5. Correcting Errors and Avoiding Audits:

Mistakes on tax returns can happen to anyone. However, filing early gives you the advantage of identifying and correcting errors before submission. By taking the time to review your returns meticulously, you minimize the chances of triggering an audit or drawing unnecessary scrutiny from tax authorities. Early filing allows for a thorough review and the opportunity to provide accurate and complete information.

Conclusion:

Filing income tax returns early offers numerous benefits that go beyond just meeting the deadline. From avoiding penalties and interest charges to reducing stress and gaining peace of mind, early filing is a smart financial move. It allows for better tax planning, faster refunds, and the opportunity to correct errors before submission. Make the wise decision this tax season and file your income tax returns early to reap these advantages and enjoy a smoother, less stressful tax-filing experience.

Remember, consulting a tax professional or referring to official tax guidelines is crucial to ensure accurate and up-to-date information for your specific tax situation.

1. Avoid Penalties and Interest Charges:

One of the most significant benefits of early filing is the ability to avoid penalties and interest charges. When you file your returns before the due date, you reduce the risk of missing the deadline, which could result in financial penalties imposed by the tax authorities. By filing early, you also give yourself ample time to rectify any errors or missing documents, ensuring a smooth and penalty-free tax filing process.

2. Expedited Refunds:

If you're eligible for a tax refund, filing early means receiving your refund sooner. The earlier you file, the quicker the tax authorities can process your return and issue your refund. By accessing your refund sooner, you can put the funds to good use, whether it's paying off debts, making investments, or saving for future goals.

3. Reduced Stress and Peace of Mind:

Tax season can be a stressful time for many individuals. By filing your income tax returns early, you alleviate the last-minute rush and the anxiety that comes with it. Instead of scrambling to gather documents and complete your return at the eleventh hour, early filing allows you to approach tax season with a sense of calmness and organization. Moreover, it frees up mental space to focus on other important aspects of your financial life.

4. Opportunity for Tax Planning:

Filing early provides you with ample time for tax planning. It allows you to review your financial situation, identify potential deductions or credits, and explore strategies to optimize your tax liability. By planning ahead, you can consult with tax professionals, analyze investment opportunities, and make informed decisions that can positively impact your tax returns.

5. Correcting Errors and Avoiding Audits:

Mistakes on tax returns can happen to anyone. However, filing early gives you the advantage of identifying and correcting errors before submission. By taking the time to review your returns meticulously, you minimize the chances of triggering an audit or drawing unnecessary scrutiny from tax authorities. Early filing allows for a thorough review and the opportunity to provide accurate and complete information.

Conclusion:

Filing income tax returns early offers numerous benefits that go beyond just meeting the deadline. From avoiding penalties and interest charges to reducing stress and gaining peace of mind, early filing is a smart financial move. It allows for better tax planning, faster refunds, and the opportunity to correct errors before submission. Make the wise decision this tax season and file your income tax returns early to reap these advantages and enjoy a smoother, less stressful tax-filing experience.

Remember, consulting a tax professional or referring to official tax guidelines is crucial to ensure accurate and up-to-date information for your specific tax situation.